Feeling Nervous About Your Investments? Thinking of buying gold?

Hey Future Millionaire,

Market panic: Is now the time to buy gold?

Markets are down. The headlines are wild. Gold is surging.

If you're feeling anxious about your investments right now, you're not alone.

Trump's trade war has really kicked off.

He looks so happy

Yesterday, both the S&P 500 and my beloved Vanguard All World Equity ETF were down 14% year-to-date.

My own net worth has taken a big hit.

And then I see headlines like: 'Investors Flocking to Gold as Stock Markets Tumble.'

I'll admit it, my first instinct was: 'Should I be buying gold too?'

Are you wondering the same thing? Here's how I think about it.

Investing is like building a house

If you're investing in building materials for a house over 20 years, you would look for good deals.

If one day roof tiles are up 20% but bricks are 20% cheaper, you buy bricks.

Investing is the same.

You're building a portfolio so you can one day live off it with a mix of materials: stocks, bonds, cash, maybe crypto, maybe gold.

Just like your house will be built using bricks, concrete, tiles and wood.

Right now, gold is up. Stocks are down. So why is everyone rushing to buy the expensive thing?

Buy low. Sell high. (And yet...)

I cover this in all my coaching conversations. Everyone knows you should buy low and sell high.

But most people panic when prices drop and chase whatever's currently soaring.

Gold just hit an all-time high of over $3,000 per ounce just before Trump's tarrif announcement.

Meanwhile, stock prices are on sale.

The stock market is going down because more people are selling than buying. Gold prices are shooting up because everyone is buying them in a panic.

As Warren Buffett wisely says:

“Be fearful when others are greedy, and greedy when others are fearful.”

If everyone's buying gold... maybe it's time to look elsewhere.

Why I'm buying stocks right now

Here's what I remind my coaching clients (and myself):

1. Prices are low

My favourite ETF, Vanguard All World, cost €140 in February. Now? It's €115.

That's an 18% discount!

There is a spring sale on stocks. If you were planning to buy anyway, why would you wait for the price to go back up?

2. The market always recovers

Stock markets have survived worse things than Donald Trump in the White House.

In the last 25 years, we've seen:

The dotcom crash and 9/11 in 2001

The 2008-2009 recession

Covid in 2020

War in Ukraine in 2022

And still, €10,000 invested in the S&P 500 in January 2000 would now be worth over €63,000.

3. The bottom can't be predicted

Some of the best days in stock market history happen during the worst times, right in the middle of crashes.

The most significant weekly gain for the S&P 500 in the past decade occurred during the week ending March 27, 2020, when the index surged by approximately 10.26%.

That was within a month of the crash caused by Covid!

These sharp rebounds are impossible to predict and often happen when investor sentiment is still low. The stock market will have started its recovery long before the news cycle picks up on it.

Miss just a few of those days, and your long-term returns plummet. That's why trying to "wait it out" often backfires.

What to do instead

Don't follow the crowds and buy stuff when it's expensive. Have a plan and stick to it.

The single best strategy for a downturn is to make sure you stay employed. Keep investing.

And remember: recoveries always reward the patient.

During the 2022 downturn my own net worth decreased by 17%.

But then from October '23 it went up 68% in 14 months.

Not because I am a genius investor, but because I kept investing when markets were down.

Want help making smart money moves during the chaos?

Feeling overwhelmed by market ups and downs? You're not alone.

My Money Mastery coaching helps you become someone who:

✅ Forever understands how money works

✅ Has a plan to achieve financial freedom for you and your family

✅ Has a purpose for every extra € in commission

✅ Will never be fooled by bad financial advice

✅ Will have €100,000s more in (early) retirement

All in just 4 calls with 3 months of Slack support.

Here's what Chris, a CFO, thought of it just this week:

And if you're not convinced after the first session, I'll give you a full refund, no questions asked.

Why not book a free call to see if it's for you? I will tell you if it isn't.

Just click the button below:

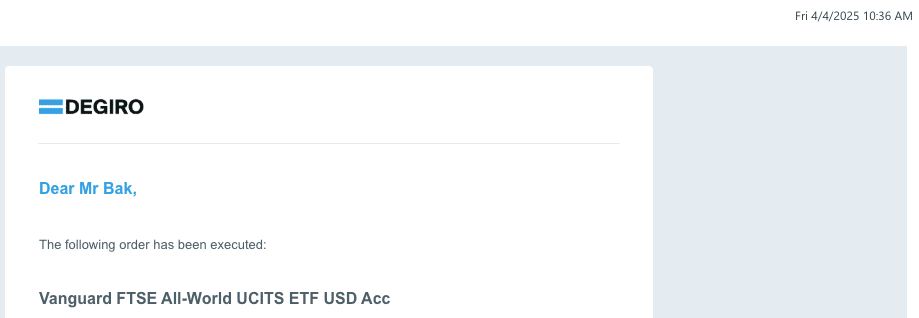

Oh, and here's the screenshot of my ETF purchase from yesterday.

I bought more Vanguard All World at that sweet discounted price.

I'm not just talking the talk; I'm buying the dip.

Would you drop me a message to let me know what you thought of today's issue? I love both hearing what you like and what I can do better, and I always respond.

Have an amazing weekend!

To your financial freedom,

Sjoerd

P.S. Want a speaker who can energise your team?

Your team will thank you for showing them how their job can help them achieve financial freedom!

Drop me an email and let's make it happen.